Protecting Your Practice — Marketing and Banking perspectives

PROTECTING YOUR PRACTICE AND STAFF – Advice From An Experienced Marketing and Banking Executive By Robert Gangi, CEO & President of RG Consulting Services LLC Creating a safe environment for your staff and clients has always been an integral part of running your practice. Now, it’s become a differntiator for you in the marketplace. Prospective… Read more »

Telemedicine & Financing

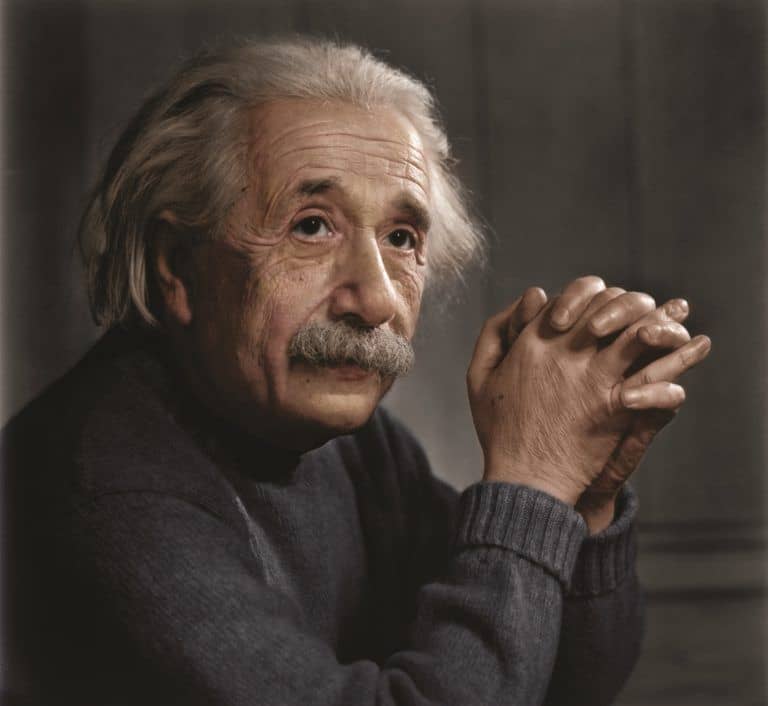

Albert Einstein was quoted: “In the middle of every difficulty lies opportunity.” Nothing could be more appropo to describe what we’re all going through right now and how Telemedicine and Teledentistry have become the proverbial lemonade from lemons. Practices of all specialties have had to change how they do what they do for their patients,… Read more »

The EIDL is back!!

THE EIDL IS BACK!!! Effective 6/15/20, the Small Business Administration reopened its Economic Injury Disaster Loan (EIDL) program to all small businesses. This is really good news for any business owner as SBA had been slowly phasing it out since its complementary re-launch alongside the 4/3/20 CARES Act. Initially, the loan limit was $2 million,… Read more »